Empowering Borrowers and Investors through Community Lending Platforms

Discover how community lending platforms are revolutionizing finance by connecting borrowers directly with lenders.

Rethinking traditional finance — one peer-to-peer loan at a time.

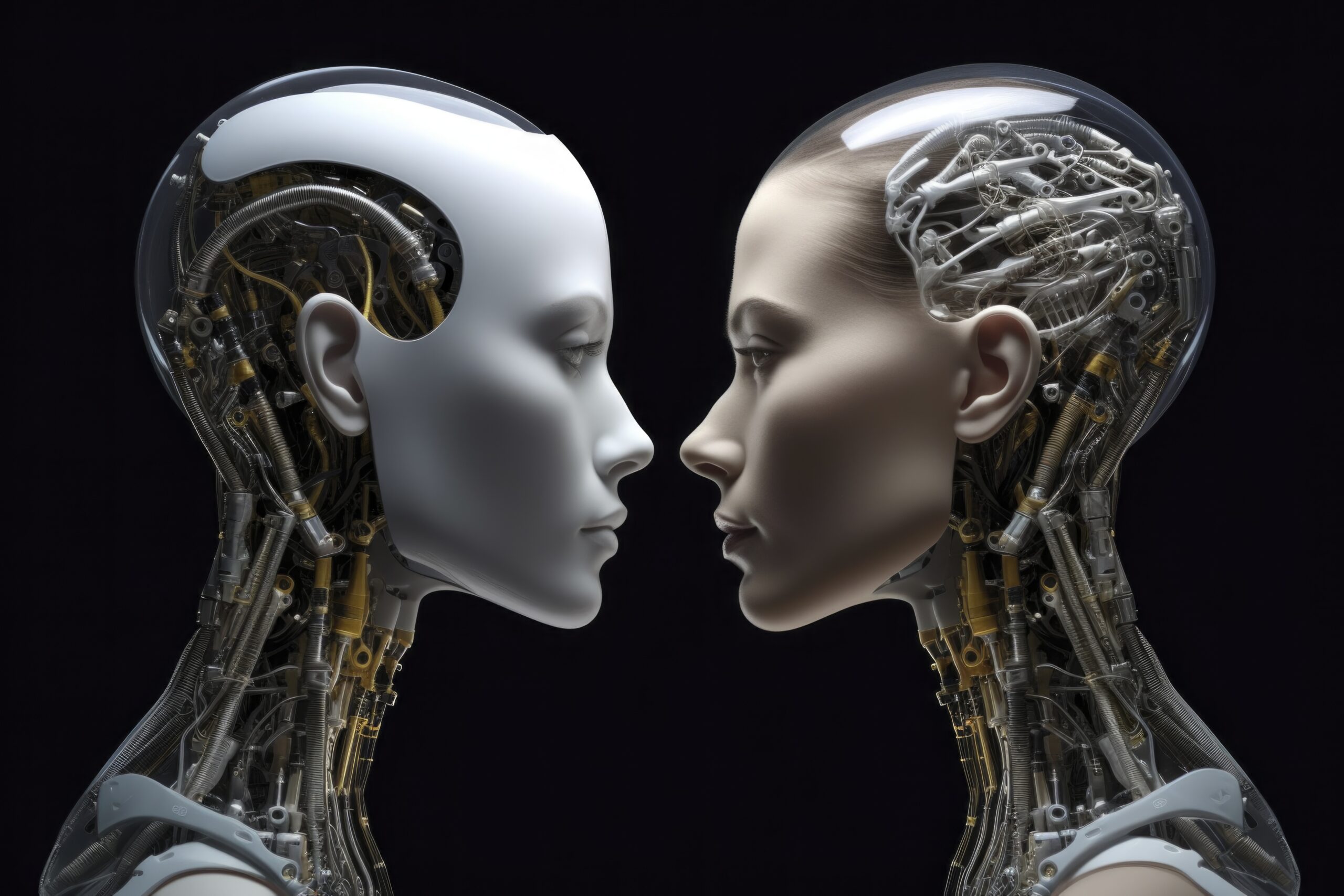

In an age where technology is reshaping every industry, community lending platforms are disrupting the traditional banking model by offering an innovative, people-powered alternative to borrowing and investing.

Also known as peer-to-peer (P2P) lending, these platforms connect individuals who need funds with others willing to lend, bypassing conventional financial institutions.

What started as a niche digital experiment has grown into a global movement, fostering financial empowerment, inclusion, and trust within local and international communities.

By enabling borrowers to access capital directly from peers and allowing investors to support personal or business goals while earning returns, community lending platforms are changing how money flows and how people relate to credit.

This model is not just about finance—it’s about people helping people. Here’s how it works, why it matters, and what you should know before getting involved.

What Makes Community Lending Platforms Unique?

Community lending platforms rely on technology to simplify and democratize access to credit. Traditional banking often involves strict credit checks, long approval times, and impersonal criteria.

In contrast, P2P platforms provide a more humanized, flexible, and transparent process. Here are the key characteristics that define these platforms:

- Direct Connections: Borrowers and lenders engage without the intermediation of banks, which reduces costs and increases efficiency.

- Customizable Terms: Loan agreements can be tailored to meet the needs of both parties, creating more accessible and fair conditions.

- Lower Barriers to Entry: Individuals with non-traditional income or limited credit histories often find more opportunities here than with banks.

- Community-Focused Impact: Many platforms prioritize funding small businesses, education, healthcare, and local development—creating real-world change.

The value lies not only in the financial transaction but also in the human connection it fosters. It’s financial cooperation instead of competition.

How the Platforms Work

The basic structure of a community lending platform is relatively simple:

- Borrower Application: Individuals or businesses submit loan requests, outlining their purpose, desired amount, and terms.

- Credit Assessment: Platforms often use a mix of data, including alternative credit scores or behavioral indicators, to evaluate risk.

- Listing and Funding: Once approved, the loan is posted on the platform. Multiple investors may contribute small amounts to fund it.

- Loan Agreement and Repayment: Once fully funded, the loan is disbursed, and borrowers begin making scheduled payments with interest.

Some platforms allow automated investment tools that diversify contributions across various loans, helping lenders reduce risk while supporting multiple borrowers.

Benefits for Borrowers and Lenders

Community lending platforms offer compelling benefits for both sides of the transaction:

For Borrowers:

- Access to funds without relying on traditional credit systems

- Lower interest rates in many cases compared to personal loans from banks

- Faster approval and more transparency in terms and conditions

- A chance to build credit and financial stability through positive repayment history

For Lenders:

- Opportunity to earn interest returns that may outperform savings accounts or bonds

- Greater control over investment choices based on causes, people, or risk levels

- Direct impact by funding education, healthcare, or small business dreams

- Flexibility to start with small contributions and grow gradually

This shared value model creates financial ecosystems rooted in empathy and mutual benefit rather than profit maximization alone.

Challenges and Considerations

As promising as community lending platforms are, they’re not without risks. For lenders, default remains a real possibility. Unlike insured deposits in banks, funds lent through P2P models are not guaranteed.

Due diligence is essential—platforms vary in their vetting processes, transparency, and loan performance metrics.

Borrowers should also read the fine print. While terms may be more flexible than banks, missed payments can still harm credit and result in collection efforts. Understanding your responsibilities is crucial.

Regulatory frameworks are still evolving in many regions, which can create uncertainty. However, increased scrutiny also brings more protections and long-term stability to the sector.

The Future of Community Lending Platforms

As more people seek alternatives to rigid financial systems, community lending continues to grow.

Innovations like blockchain-based lending, decentralized credit scoring, and AI-driven risk assessment are making the model even more robust.

Governments and nonprofits are also exploring partnerships with these platforms to enhance access to capital for underbanked populations.

The potential for social good is immense when finance is powered by community values.

Final Thoughts

Community lending platforms are more than just digital tools—they’re financial lifelines that represent a shift toward a more equitable, transparent, and connected economic future.

By placing people at the heart of lending, they foster trust, empower growth, and prove that money can move with purpose.