Income tax application: How to download for free

Check here how to download the income tax app. It is completely free and available to you!

As a new year begins, the Federal Revenue Service is already beginning to define the date for the IRPF declaration. And one way to facilitate this process is with the Income Tax app, which can be downloaded for free. Find out now how to install Income Tax app in a simple way.

What is the Income Tax application?

O Income Tax app is a tool developed by the Federal Revenue Service with the aim of making taxpayers’ lives easier.

It is important to highlight that the platform is a complement to make the entire Income Tax declaration and payment process easier.

This is because taxpayers must make their declaration through the website of the responsible body, however, the tool provides several resources to its users.

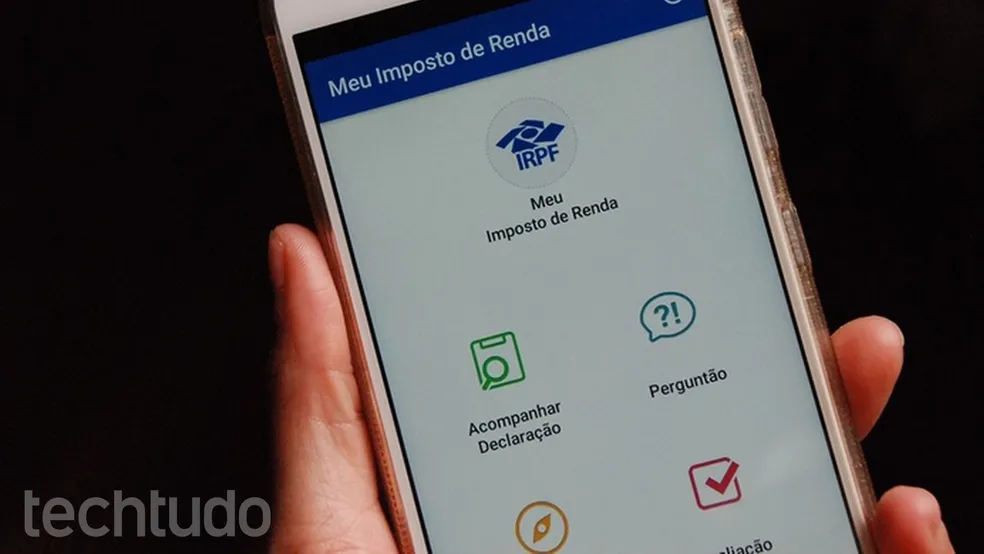

Currently, the app is called My Income Tax and can be downloaded on different electronic devices.

How does the IRPF app work?

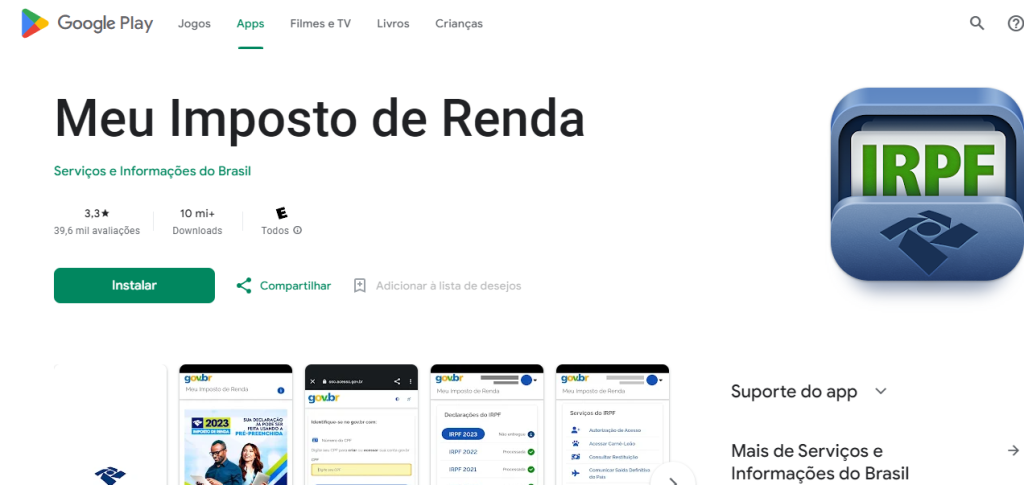

Initially, the Federal Revenue page offers several versions of the application. However, it is worth saying that the most current option is in the official Play Store and App Store app stores.

Remembering that to start using the application, users need to authenticate their account through the Gov.br page.

This way, it is possible to have access to all the features that the application can offer to its taxpayers.

Furthermore, if your account is at the silver or gold level, you can have access to all services, even from previous statements.

Finally, when you download the app and authenticate your account, you will have access to the following features:

- Ease of filling out the 2023 declaration with the pre-filled one;

- Viewing delivery receipts;

- Copies of declarations;

- Rectification of statements;

- Query pending issues;

- Check debts;

- DARF issuance, with barcode and possibility of PIX.

Who can download the app?

Before downloading the application, you need to know who can or cannot have access to download this tool.

In principle, the Brazilian Federal Revenue application is intended for Individual Income Tax – IRPF declarants.

Furthermore, it is essential to say that interested parties need to comply with some basic criteria to carry out the process in a simple way, such as:

- Be of minimum age;

- Have a compatible cell phone;

- Comply with the app's usage policies.

So, once you meet all these requirements, you can easily download the app on your cell phone.

Step by step to download the Income Tax application

One of the main objectives of the tool is to ensure greater ease for taxpayers, especially when it comes to accessing important IRPF information.

For you to download the app, the user must access the application store on their cell phone.

Remembering that the app is available on the main systems, such as Android and iOS. Therefore, your cell phone needs to be compatible with the latest version.

Although it is a very simple process, we decided to provide a step-by-step guide, showing each important step. Check it out below!

Android

- Access the Play Store app store clicking here;

- Then, in the search bar, type “My Income Tax;

- Then, click on the option presented in the search result;

- Finally, press the “Install” button.

iOS

- Access the App Store store this way;

- Then, in the search bar, type “My Income Tax;

- Then, click on the option presented in the search result;

- Finally, press the “Get” button.